WHY MULTIFAMILY

WHY MULTIFAMILY

Multifamily Real Estate

A basic human need

Apartments address the basic human need for "a roof over our head". Whether the economy is going up or down, people need a place to live. During the last housing crisis, multifamily investments had a default rate of 3-4% compared to single family homes at 10-11% proving to be a very stable Real Estate sector to invest in with minimal risk .

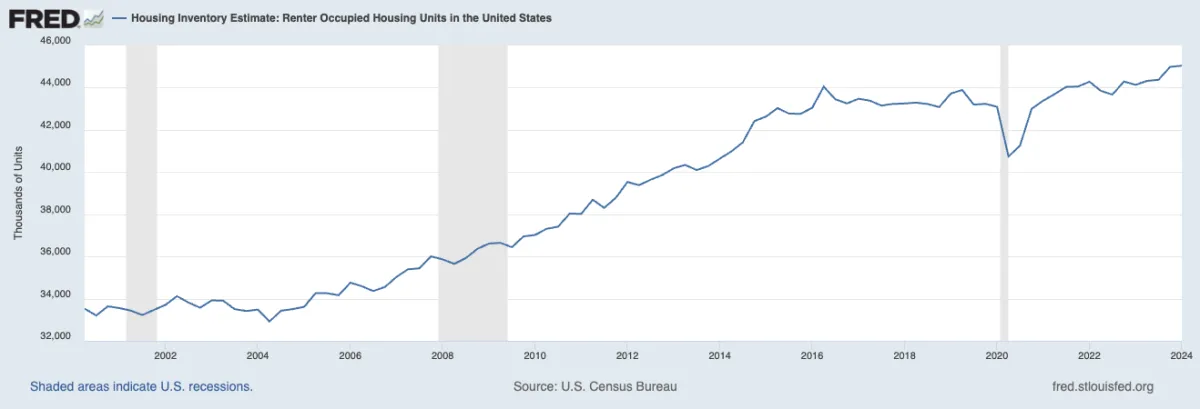

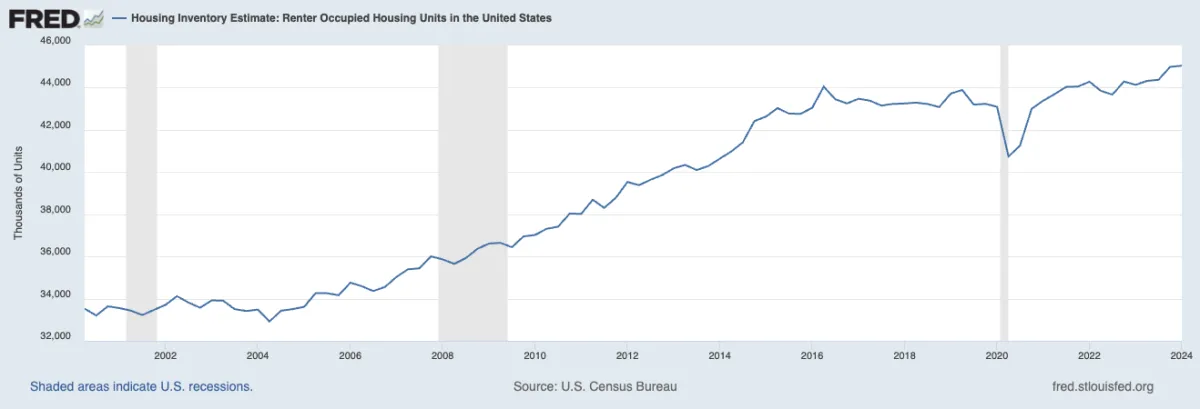

Not to mention that demand for apartments is at an all-time high, population is continuing to increase which drives the demand for apartment living higher and higher. Low vacancy rates and demand for housing equals greater cash flow as well as equity growth through appreciation which translates to higher returns for our investors.

Demand for apartments is at an all-time high and still climbing

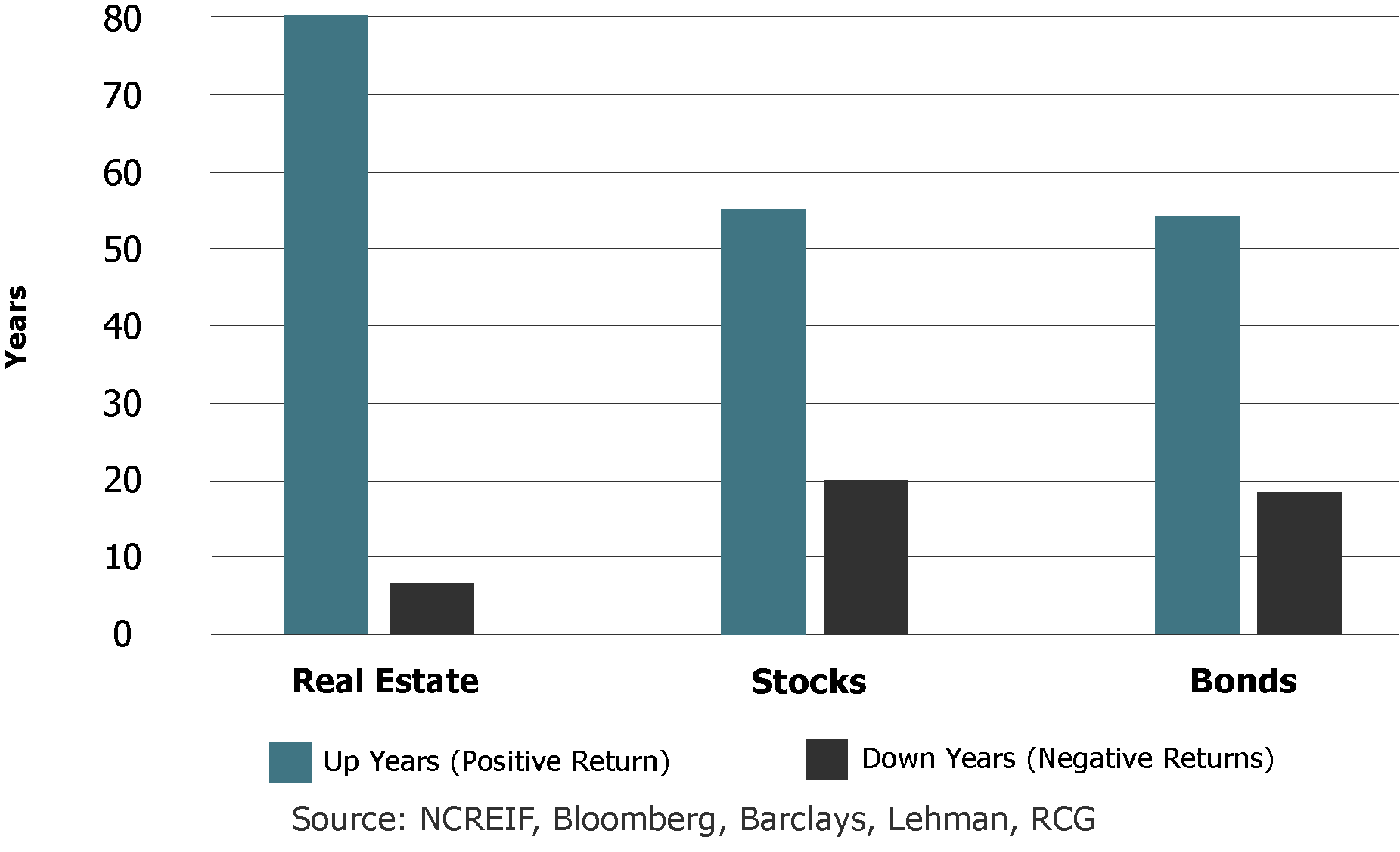

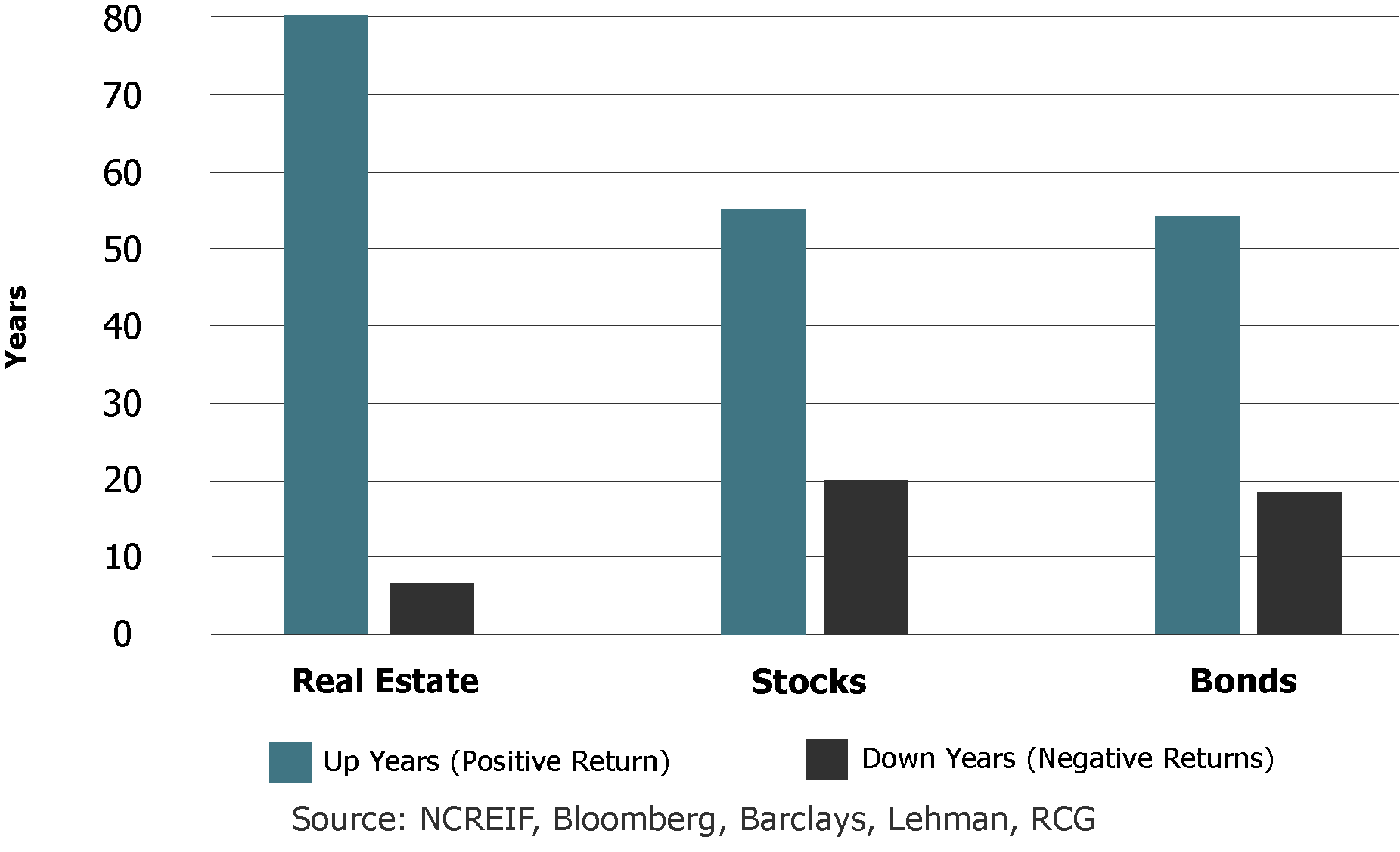

Apartments have historically outperformed stocks & bonds

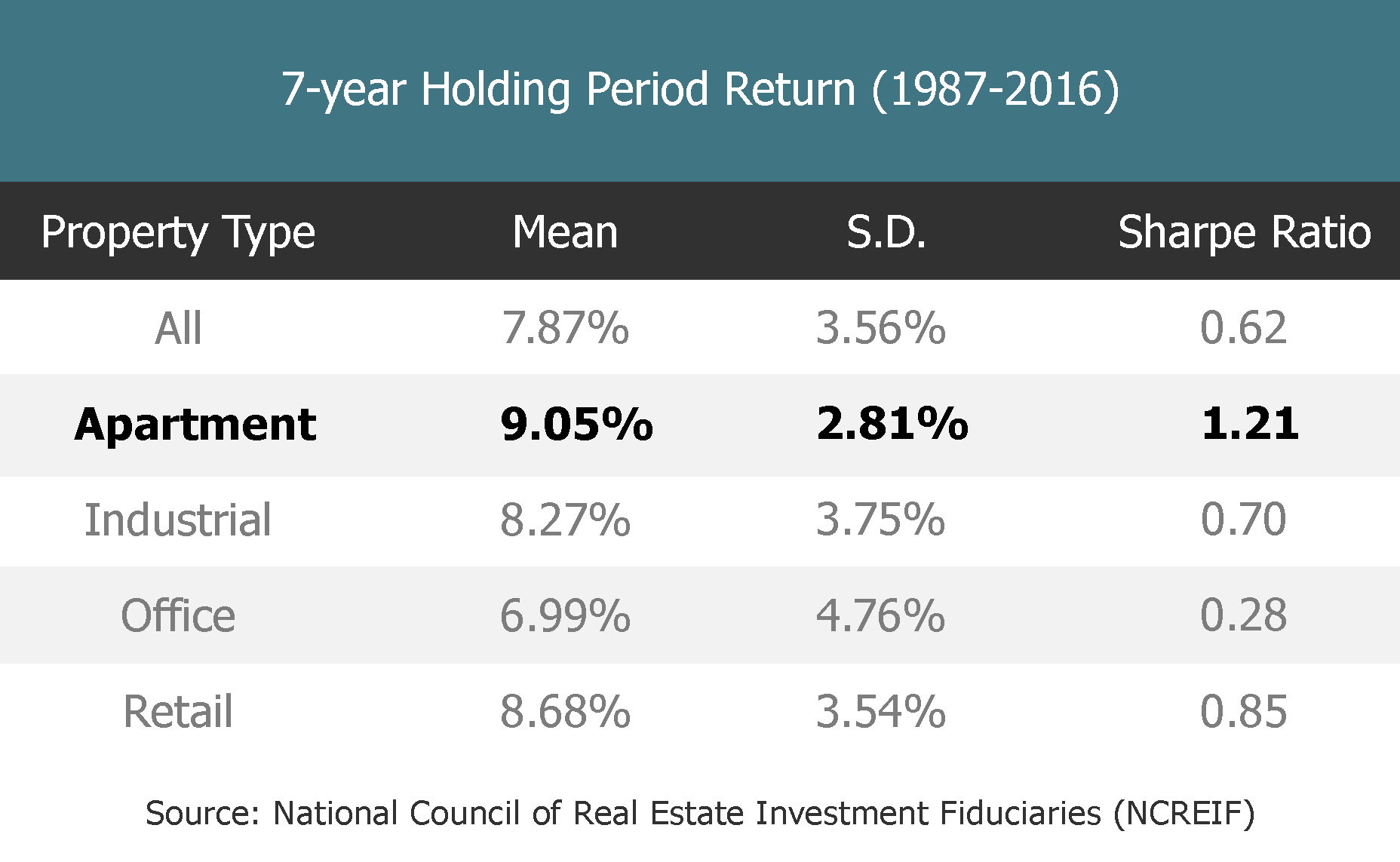

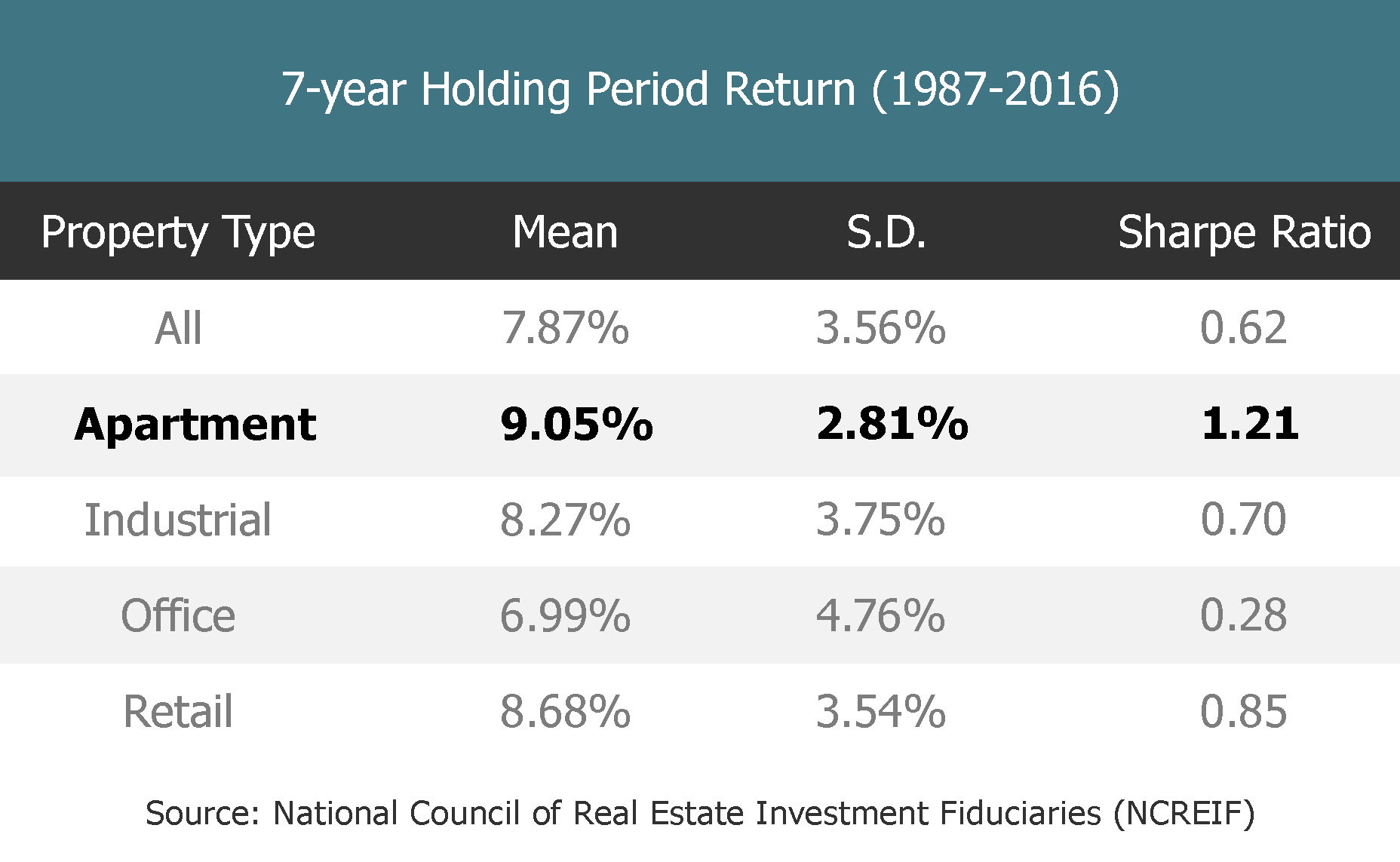

Multifamily investments have historically out performed other real estate classes

Multifamily Real Estate

A basic human need

Apartments address the basic human need for "a roof over our head". Whether the economy is going up or down, people need a place to live. During the last housing crisis, multifamily investments had a default rate of 3-4% compared to single family homes at 10-11% proving to be a very stable Real Estate sector to invest in with minimal risk .

Not to mention that demand for apartments is at an all-time high, population is continuing to increase which drives the demand for apartment living higher and higher. Low vacancy rates and demand for housing equals greater cash flow as well as equity growth through appreciation which translates to higher returns for our investors.

Demand for apartments is at an all-time high and still climbing

Apartments have historically outperformed stocks & bonds

Multifamily investments have historically out performed other real estate classes

BENEFITS OF INVESTING IN MULTIFAMILY ASSETS

TAX ADVANTAGED INCOME

Investors utilizing leverage depreciation, cost-segregation and Section 1031 exchanges can defer taxation on much of their real estate income into perpetuity.

HEDGE AGAINST INFLATION

Multifamily property values have proven to be virtually a perfect inflation hedge - .98 correlation since 1978 when reliable data became available.

HEDGE AGAINST RECESSION

JP Morgan looked at the worst five-year periods for various investments from 1977-2012 and calculated total return (including cash flow). $100 invested in apartments at the beginning of the worst five-year period for real estate was worth $110 at the end. A portfolio of 60% stocks/40% bonds was worth $94 at the end of its worst five years.

SUPERIOR RISK-ADJUSTED RETURN

For decades, multifamily has exhibited the least volatility and highest risk-adjusted returns of all real estate asset classes. This long-term performance along with tax and hedging benefits has been amplified in the short term.

BENEFITS OF INVESTING IN MULTIFAMILY ASSETS

TAX ADVANTAGED INCOME

Investors utilizing leverage depreciation, cost-segregation and Section 1031 exchanges can defer taxation on much of their real estate income into perpetuity.

HEDGE AGAINST INFLATION

Multifamily property values have proven to be virtually a perfect inflation hedge - .98 correlation since 1978 when reliable data became available.

HEDGE AGAINST RECESSION

JP Morgan looked at the worst five-year periods for various investments from 1977-2012 and calculated total return (including cash flow). $100 invested in apartments at the beginning of the worst five-year period for real estate was worth $110 at the end. A portfolio of 60% stocks/40% bonds was worth $94 at the end of its worst five years.

SUPERIOR RISK-ADJUSTED RETURN

For decades, multifamily has exhibited the least volatility and highest risk-adjusted returns of all real estate asset classes. This long-term performance along with tax and hedging benefits has been amplified in the short term.

Learn How To Become An Investor/Partner With Us

We welcome inquiries from investors seeking multifamily investment opportunities.

Learn How To Become An Investor/Partner With Us

We welcome inquiries from investors seeking multifamily investment opportunities.

Elevate Capital Investments LLC focuses on sourcing multi-family assets with value-add opportunities in emerging markets in order to grow and protect our passive investors’ capital.

©2024 Elevate Capital Investments LLC.

All Rights Reserved.

Elite CRE Investments Gp LLC focuses on sourcing multi-family assets with value-add opportunities in emerging markets in order to grow and protect our passive investors’ capital

©2024 Elite CRE Investments LLC . All Rights Reserved.

Privacy Policy I Terms